justhavealook/iStock Unreleased via Getty Images

Investment Thesis

In this article, I aimed to use alternative data to track the progress of both Shopee and Garena. According to Google Trend and SensorTower, Shopee continues to lead Southeast Asia (“SEA”) as it is ranked as the no.1 shopping app across the region. In Brazil, it is ranked 2nd, surpassing Mercado Libre. For Garena, Free Fire’s monthly active users are stabilizing, and its new game releases can be tracked via data.ai, with Primitive Era being the most recent launch. This indicates that the management is working on developing their own games, along with Phoenix Lab. The company’s overall hiring has slowed down rapidly with October 2022 being the lowest in terms of job openings. This goes to show that management is working on accelerating the route to profitability.

And if you have not already known, I have also recently published a deep dive into why I think Sea Limited’s (NYSE:SE) long-term fundamentals are intact and why its valuation may be attractive for investors in the long term.

Shopee

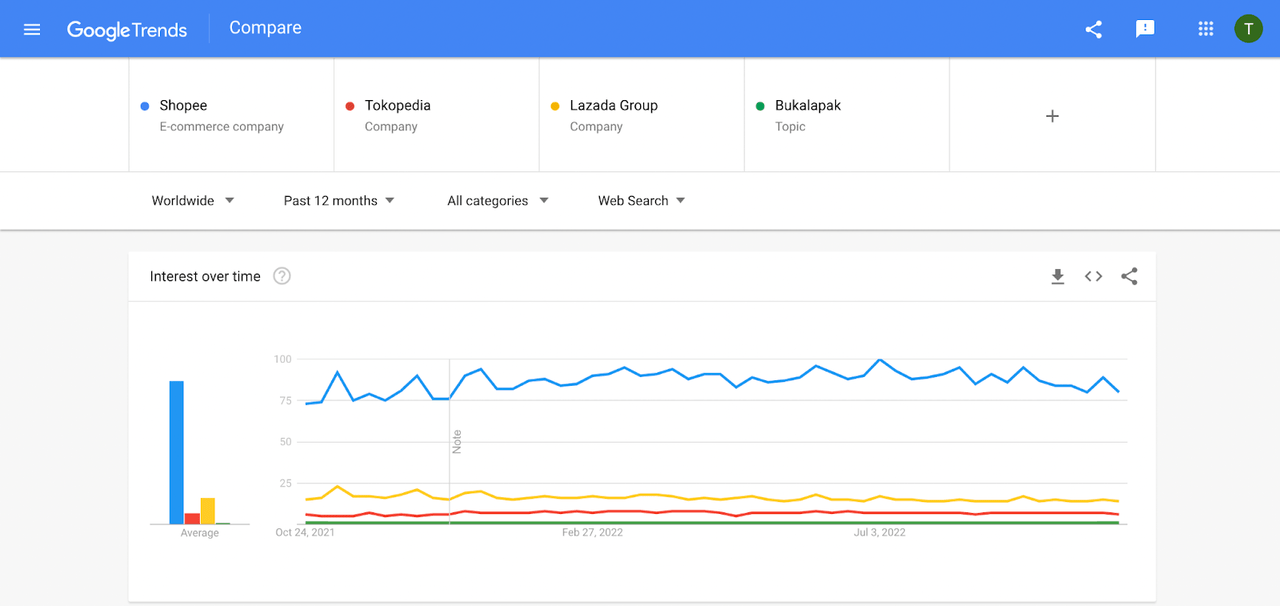

Google Trends

Google Trends

Google Trend shows that Shopee continues to lead its competitors primarily Tokopedia (IDX: GOTO), Lazada (BABA), and Bukalapak (IDX: BUKA) by a mile. Although, we did see that there was a slight deceleration at the end.

Rankings

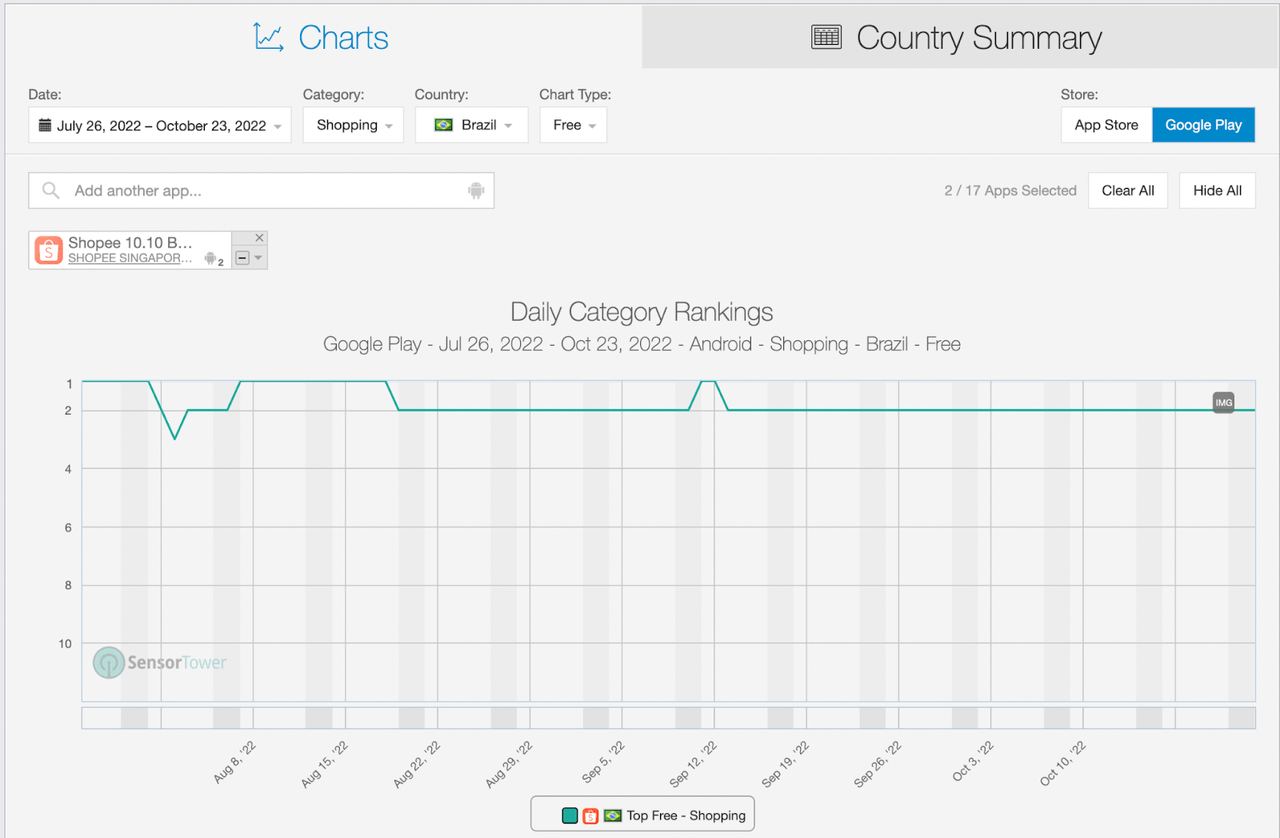

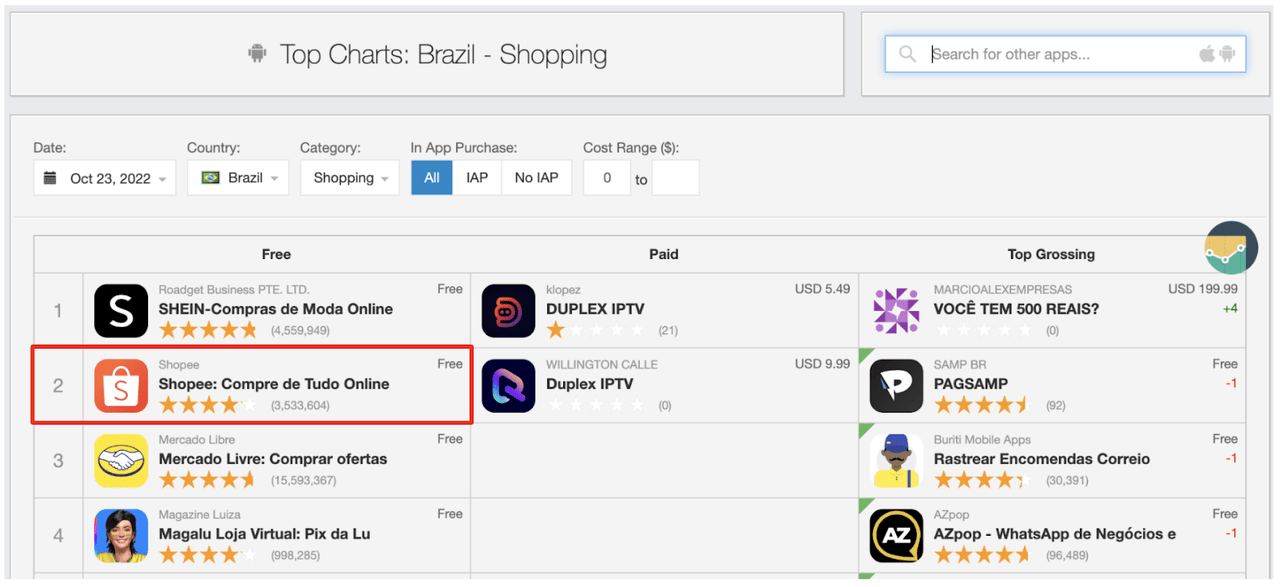

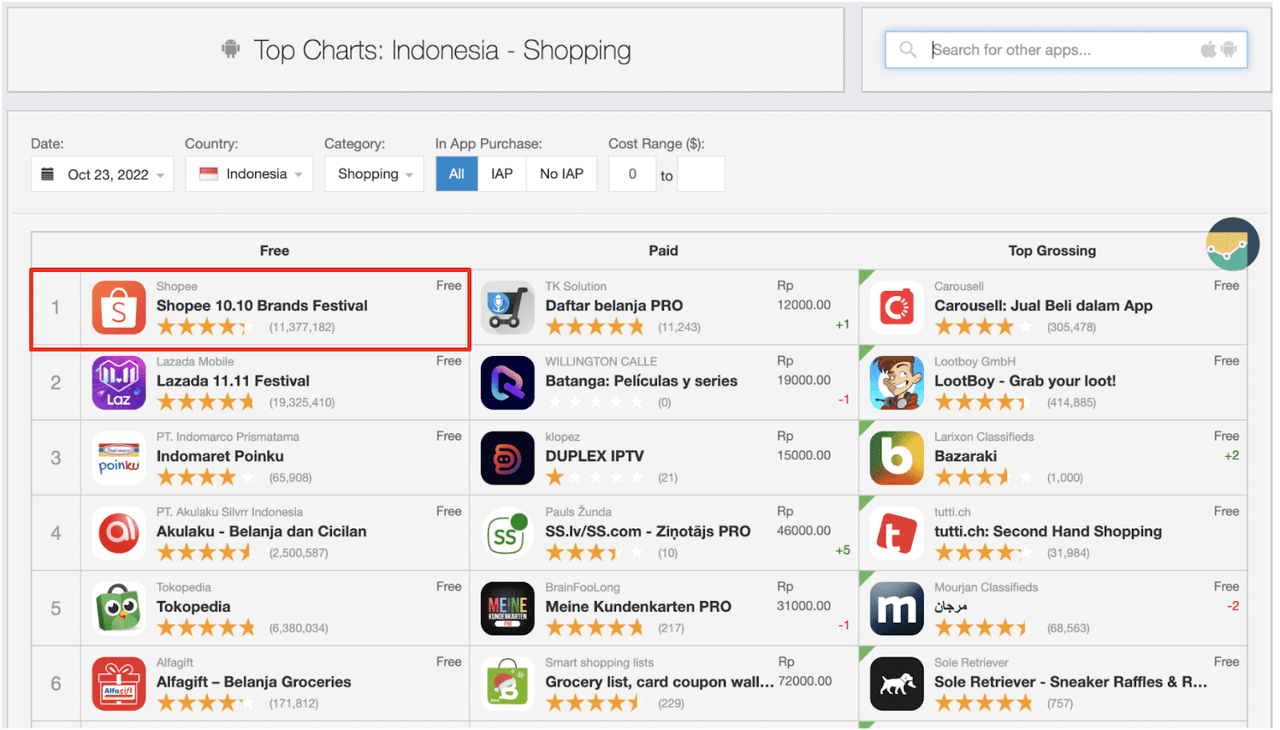

SensorTower

SensorTower

Shopee has consistently ranked as the number 2 shopping app in Brazil, surpassing MercadoLibre (MELI), although SheIn continues to lead the pack. This shows that Shopee’s mobile-first approach is working, and they are gaining momentum in the region. Ideally in the upcoming 3Q22 earnings call, we want to see its adjusted loss per order decrease at a faster rate. In 2Q22, its loss per order has only improved by a mere 7% Q/Q compared to 24% Q/Q in 1Q22.

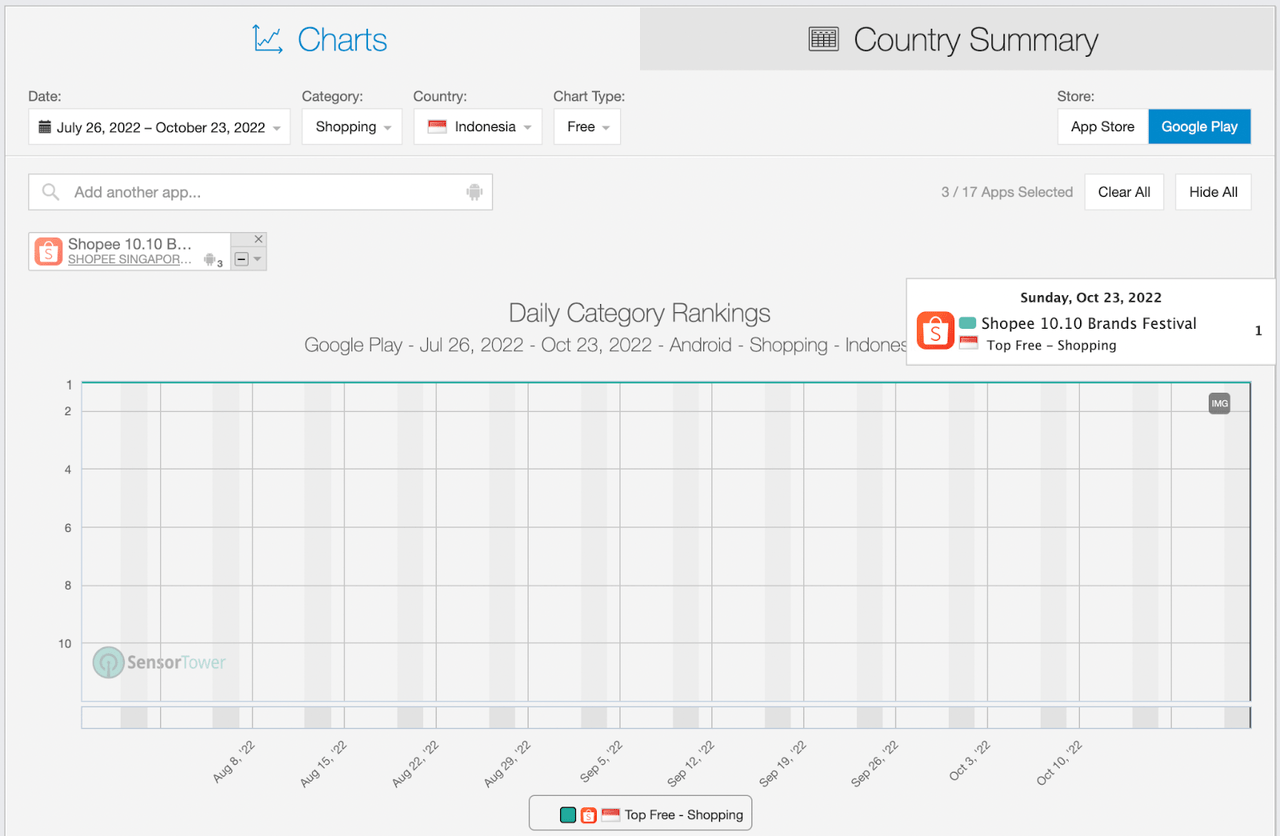

SensorTower

SensorTower

In Indonesia, which is Shopee’s largest market in Southeast Asia (“SEA”) continues to rank 1st, surpassing its closest competitor, Lazada. This is the same for the rest of the markets in the region, which is in line with the Google Trend that was shown earlier on.

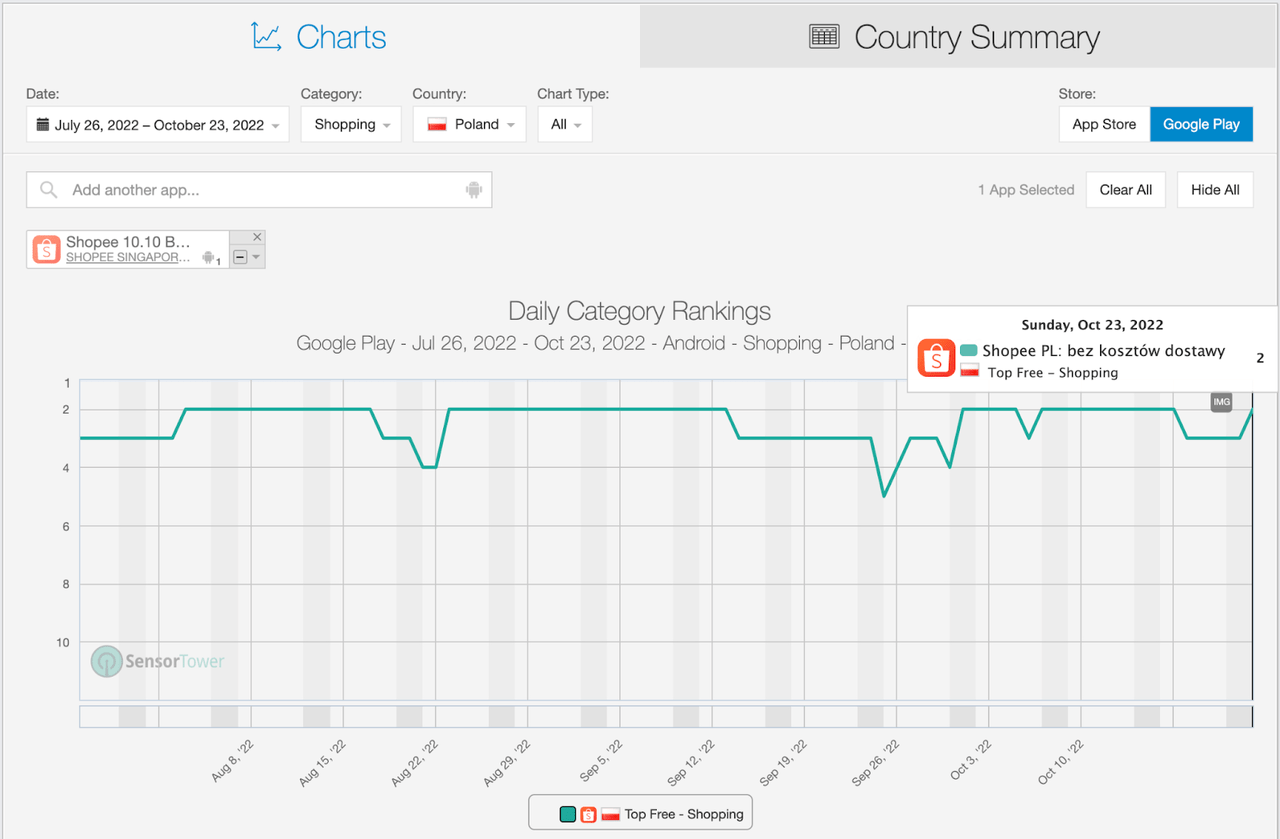

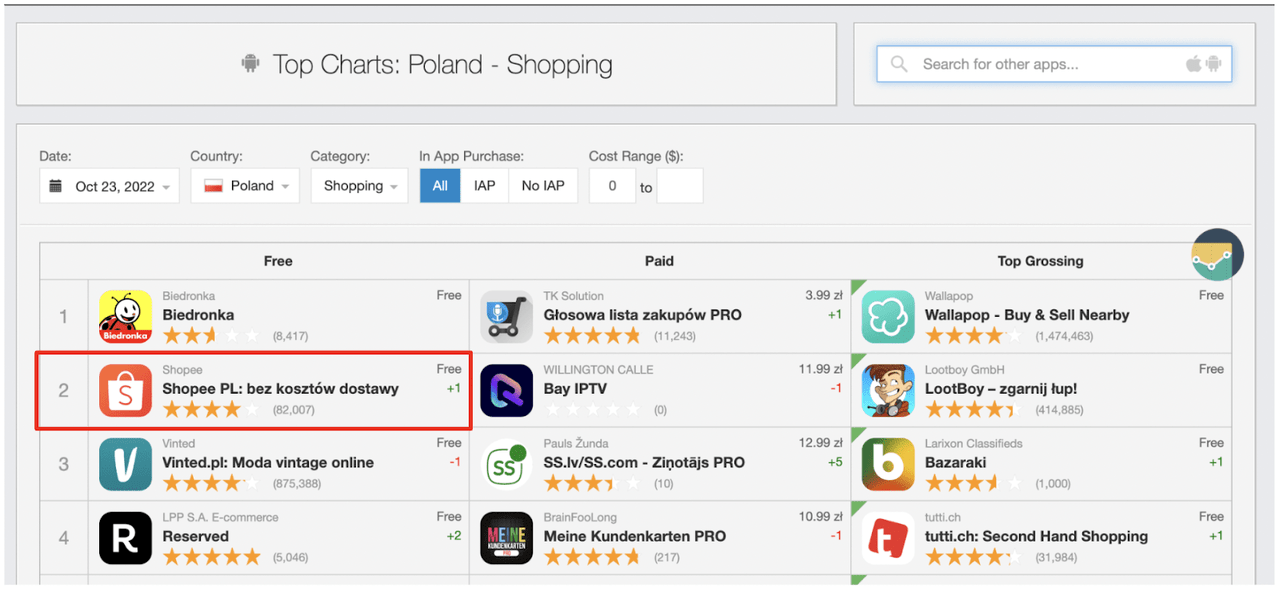

SensorTower

SensorTower

Shopee is currently ranked 2nd in Poland, with Biedronka leading. Biedronka is one of Poland’s largest discount retail chains designed to provide consumers with low-priced goods. As Shopee Poland’s rankings tend to fluctuate, and it remains one of the 2 markets that the management has not exited from, I will not be too surprised if they decided to exit the region.

Garena

Recap and Updates

Here is a recap of what I covered in my previous article – (1) Phoenix Labs has a pipeline of games, and one of its games, Fae Farm, is set to be launched in Spring 2023 (23 March to 23 June), and (2) Garena invested in Vic Game Studio.

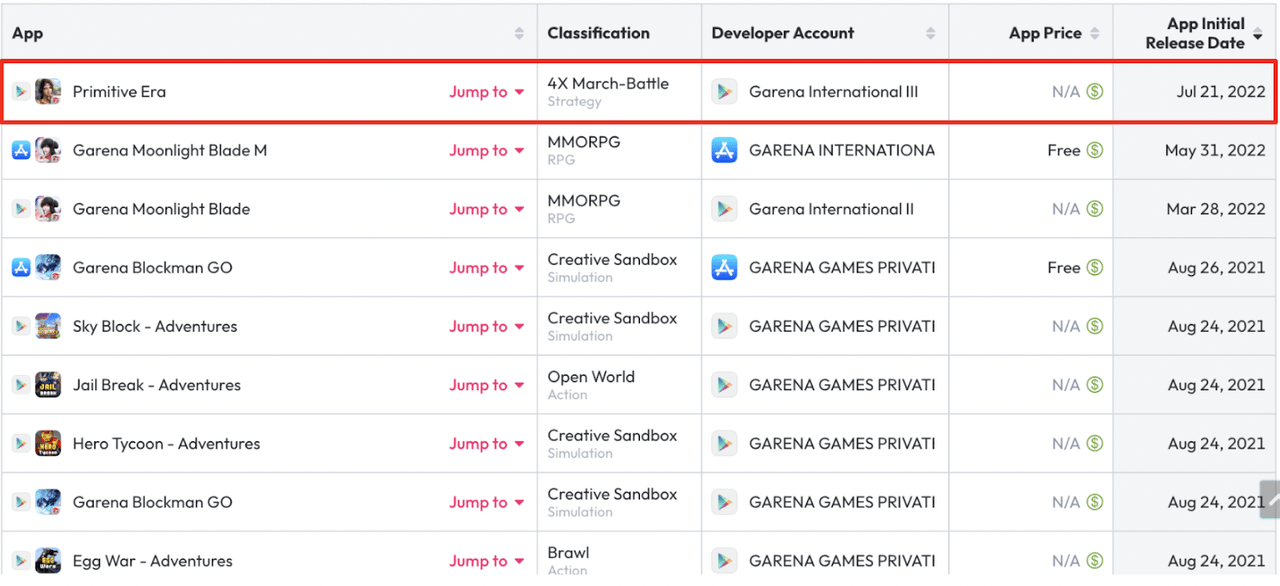

Data.ai

Through Data.ai, we can track new games released by Garena, with its most recent game being the Primitive Era. Here is a gameplay of Primitive Era, and based on Google Play Store, it has over 500,000 downloads today. Perhaps investors interested in monitoring Garena’s new games can use Data.ai. While this does not guarantee Garena’s success in reaccelerating its growth rates, it does show that the management has been working on self-developing their own games.

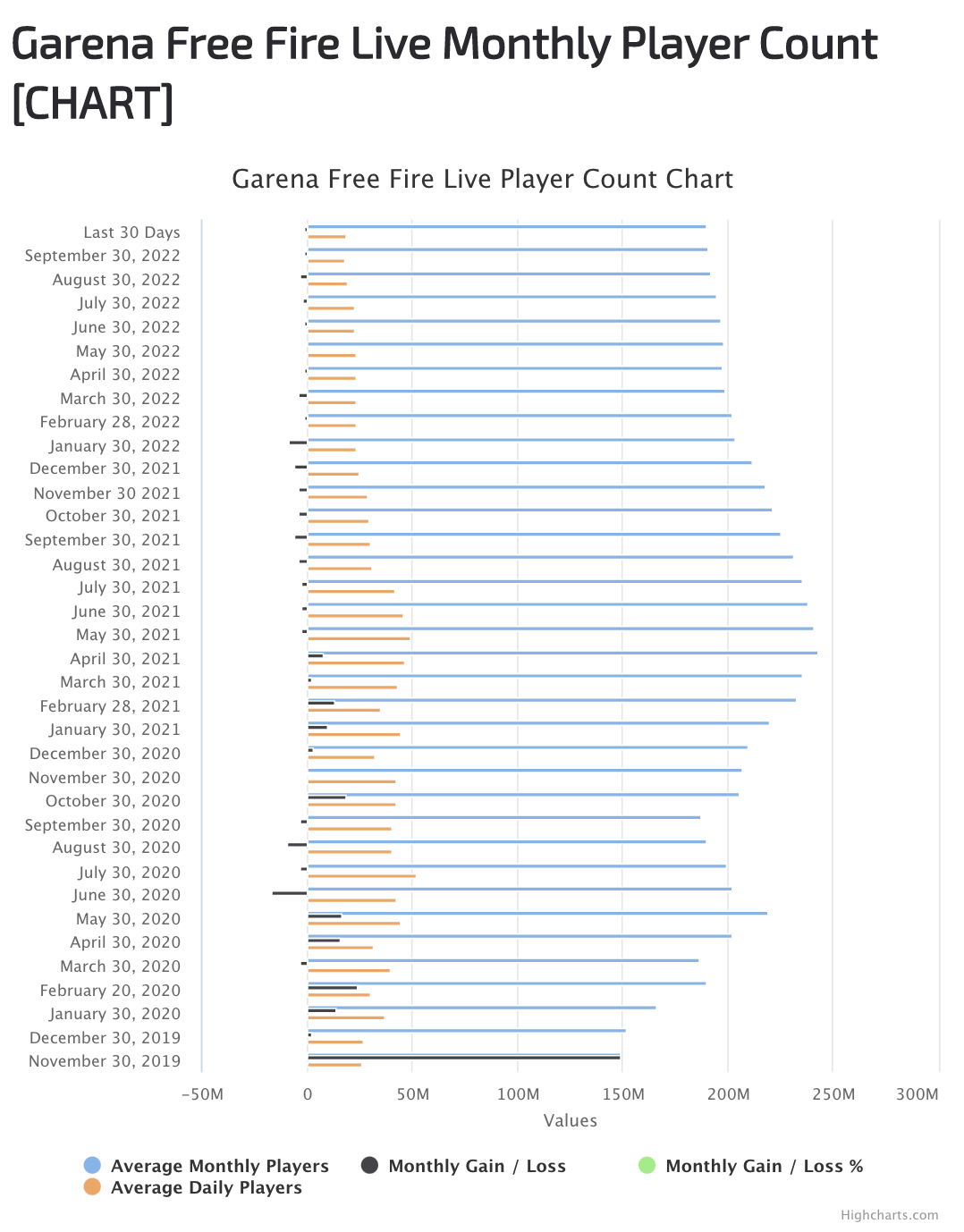

Free Fire’s Monthly Active Users Is Stabilizing

Activeplayer.io

According to Activeplayer.io, Garena’s Free Fire monthly active users (“MAU”) have stabilized in the last 3 months, which is in line with the management commentary in the past few earnings calls.

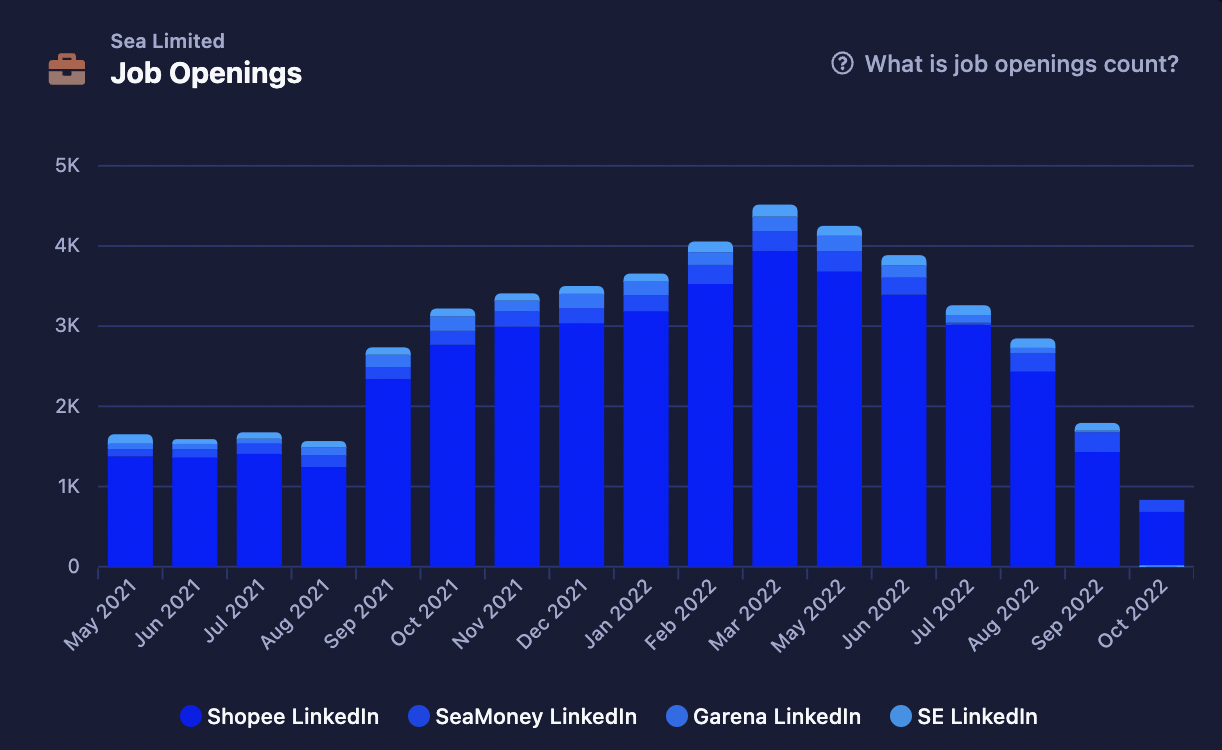

Job Openings Have Slowed Down Massively

Strike.Market

The company’s job openings have decelerated massively over the past few months, with Oct 2022 coming in at the lowest. This is so after the recent layoffs and decision to exit multiple Latin American markets. This tells us that management is serious about hitting profitability with hiring tuning down so quickly.

Conclusion

Using alternative data, we can see that Shopee continues to maintain its market leadership in SEA as evidenced by the Google Trend and app rankings on SensorTower. In Brazil, Shopee continues to surpass Mercado Libre as the number 2 shopping app, just behind SheIn. Ideally in the next couple of quarters, we want to see the loss per order improved at a faster rate in Brazil. Whereas for Garena, we can see that Free Fire’s MAU has been stabilizing for the past few months. Based on Data.ai, we can track the new game releases, with Primitive Era being the most recent launch. The company’s hiring has also slowed down really quickly in the past few months, indicating that they are taking steps toward hitting profitability.

Finally, let me know your thoughts in the comment section below!